Things To Know About Singapore Property For Foreigners – A Full Guide

Contents

- 1 Things To Know About Singapore Property For Foreigners – A Full Guide

Singapore is one of the most attractive destinations for foreigners who want to buy property, whether for investment, retirement, or relocation. However, buying property in Singapore as a foreigner is not as straightforward as it may seem.

There are many rules, regulations, taxes, and fees that you need to be aware of before you make your decision. In this article, we will provide you with a comprehensive guide on everything you need to know about Singapore property for foreigners, from the types of property you can buy to the eligibility criteria, to the financing options, to the legal procedures, and more.

We will also answer some of the most common questions that foreigners have when buying property in Singapore, and give you some tips on how to find the best property for your needs and budget. Whether you are looking for a luxury landed house in Sentosa Cove, a cozy studio unit on the East Coast, or anything in between, this article will help you navigate the Singapore property market with ease and confidence.

Key Takeaways

| Type of Property | Eligibility Criteria | Taxes and Fees | Financing Options |

|---|---|---|---|

| HDB Flat | Only for Singapore citizens and PRs | Buyer’s Stamp Duty, Mortgage Stamp Fee, Legal Fee, Valuation Fee, Agent Fee | CPF Housing Grant, HDB Loan, Bank Loan |

| Executive Condominium (EC) | Only for Singapore citizens and PRs who meet the income ceiling and family nucleus requirements | Buyer’s Stamp Duty, Mortgage Stamp Fee, Legal Fee, Valuation Fee, Agent Fee, Resale Levy (if applicable) | CPF Housing Grant, HDB Loan, Bank Loan |

| Private Condominium | No restrictions for foreigners, except for Sentosa Cove | Buyer’s Stamp Duty, Additional Buyer’s Stamp Duty (ABSD), Mortgage Stamp Fee, Legal Fee, Valuation Fee, Agent Fee | Bank Loan, Foreign Currency Loan |

| Landed Property | Only for Singapore citizens and PRs, and foreigners with special approval from SLA | Buyer’s Stamp Duty, Additional Buyer’s Stamp Duty (ABSD), Mortgage Stamp Fee, Legal Fee, Valuation Fee, Agent Fee, Property Tax | Bank Loan, Foreign Currency Loan |

Types of Property You Can Buy in Singapore as a Foreigner

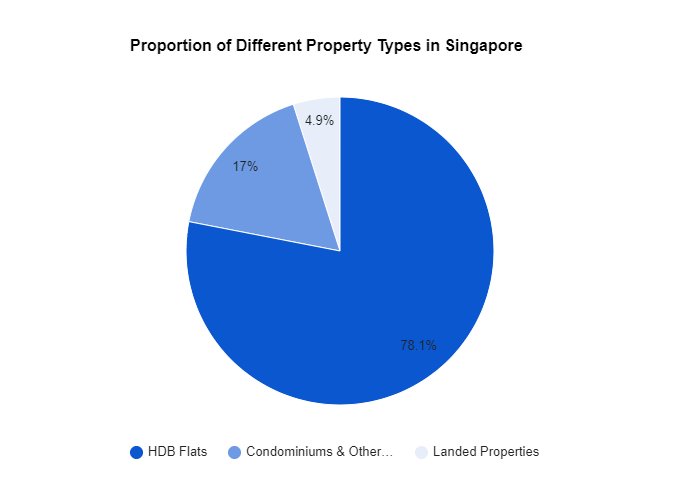

One of the first things you need to know about Singapore property for foreigners is the types of property you can buy. Singapore has three main types of residential properties: HDB flats, executive condominiums (ECs), and Private properties. Each type has its own eligibility criteria, taxes and fees, and financing options. Let’s take a look at each type in detail.

HDB Flats

HDB flats are public housing units that are subsidized and regulated by the Housing and Development Board (HDB). They are the most common and affordable type of housing in Singapore, accounting for about 80% of the resident population. HDB flats come in various sizes and designs, ranging from studio apartments to five-room flats.

However, HDB flats are not available for foreigners to buy. HDB flats are only for Singapore citizens and permanent residents (PRs) who meet the eligibility criteria, such as having a family nucleus, being at least 21 years old, and not owning any other property. HDB flats are also subject to a minimum occupancy period (MOP) of five years, during which the owners cannot sell, rent out, or transfer their flats.

If you are a foreigner who wants to buy an HDB flat, you will need to become a Singapore citizen or PR first. You will also need to pay various taxes and fees, such as the buyer’s stamp duty, the mortgage stamp fee, the legal fee, the valuation fee, and the agent fee. You can also apply for the CPF housing grant, which is a subsidy from the government that helps you pay for your flat. You can also choose between an HDB loan or a bank loan to finance your flat purchase.

Executive Condominiums (ECs)

Executive condominiums (ECs) are a hybrid type of housing that combines the features of HDB flats and private condominiums. ECs are developed and sold by private developers, but they are subsidized and regulated by the HDB. ECs offer more amenities and facilities than HDB flats, such as swimming pools, gyms, and security. ECs are also larger and more spacious than HDB flats, ranging from three-bedroom units to penthouses.

However, ECs are also not available for foreigners to buy. ECs are only for Singapore citizens and PRs who meet the eligibility criteria, such as having a family nucleus, being at least 21 years old, and not exceeding the income ceiling of $16,000 per month. ECs are also subject to an MOP of five years, during which the owners cannot sell, rent out, or transfer their unit. After the MOP, ECs can be sold to Singapore citizens and PRs only. After 10 years, ECs become fully privatized and can be sold to anyone, including foreigners.

If you are a foreigner who wants to buy an EC, you will need to become a Singapore citizen or PR first. You will also need to pay various taxes and fees, such as the buyer’s stamp duty, the mortgage stamp fee, the legal fee, the valuation fee, and the agent fee. You may also need to pay a resale levy if you have previously bought a subsidized flat from the HDB. You can also apply for the CPF housing grant, which is a subsidy from the government that helps you pay for your unit. You can also choose between an HDB loan or a bank loan to finance your unit purchase.

FAQs

- Q: What is the difference between an EC and a private condo?

- A: An EC is a subsidized and regulated type of housing that is similar to a private condo, but with some restrictions on ownership and resale. A private condo is a fully private and unregulated type of housing that has no restrictions on ownership and resale.

- Q: How can I check my eligibility for buying an EC?

- A: You can check your eligibility for buying an EC by visiting the HDB website and filling out the online application form. You will need to provide information such as your income, family nucleus, citizenship, and property ownership status.

Private Properties

Private properties are the most expensive and luxurious type of housing in Singapore. They are developed and sold by private developers, and they are not subsidized or regulated by the HDB. Private properties offer the most amenities and facilities, such as swimming pools, gyms, tennis courts, and security. Private properties are also the most diverse and varied in terms of size, design, and location, ranging from studio apartments to bungalows.

Private properties are the only type of housing that foreigners can buy in Singapore, without any restrictions, except for one area: Sentosa Cove. Sentosa Cove is a man-made island resort that is designated as a special residential zone, where foreigners can buy landed properties, such as villas and bungalows, without any approval from the Singapore Land Authority (SLA). However, Sentosa Cove properties are very expensive and exclusive, and they are subject to certain conditions, such as having to occupy the property within two years of purchase, and not being able to rent out the property for more than three years.

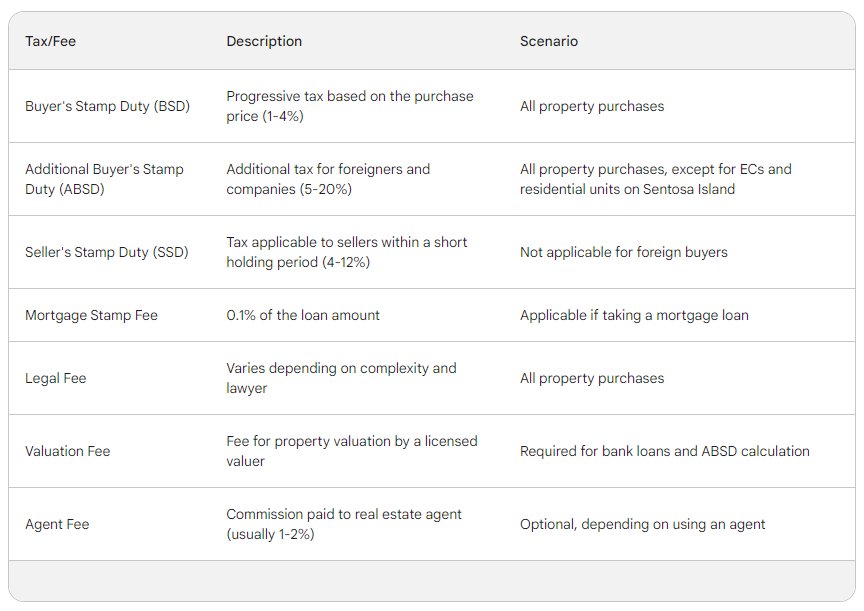

A Table Outlining the Taxes/Fees, Description, and Application Scenarios

If you are a foreigner who wants to buy a private property in Singapore, you will need to pay various taxes and fees, such as the buyer’s stamp duty, the additional buyer’s stamp duty (ABSD), the mortgage stamp fee, the legal fee, the valuation fee, and the agent fee. The ABSD is a tax that is imposed on foreigners who buy residential properties in Singapore, and it ranges from 15% to 20% of the property’s purchase price, depending on the quantity and variety of properties types under your ownership.

You can also choose between a bank loan or a foreign currency loan to finance your property purchase. A bank loan is a loan that is denominated in Singapore dollars, and it is subject to the loan-to-value (LTV) limits and the total debt servicing ratio (TDSR) rules set by the Monetary Authority of Singapore (MAS). A foreign currency loan is a loan that is denominated in a foreign currency, and it is not subject to the LTV limits and the TDSR rules, but it is subject to the currency exchange rate fluctuations and the interest rate risks.

FAQs

- Q: What are the benefits of buying a private property in Singapore as a foreigner?

- A: Some of the benefits of buying a private property in Singapore as a foreigner are:

- You have more choices and flexibility in terms of property types, sizes, designs, and locations.

- You can enjoy more privacy, comfort, and luxury in your own property.

- You can benefit from the long-term capital appreciation and rental income potential of your property.

- You can diversify your investment portfolio and hedge against inflation and currency risks.

- You can access the high-quality education, healthcare, and lifestyle options that Singapore offers.

- Q: How can I find the best private property for my needs and budget in Singapore?

- A: Some of the ways you can find the best private property for your needs and budget in Singapore are:

- Do your research online and offline to understand the market trends, prices, and availability of different properties.

- Engage a reputable and experienced real estate agent who can help you with the property search, negotiation, and transaction process.

- Visit the property showrooms, websites, and online platforms of various developers and sellers to compare and contrast the features and benefits of different properties.

- Seek professional advice from a lawyer, a banker, and a valuer to ensure that you are getting a fair and legal deal.

Demystifying the Purchase Process for Foreigners

Another thing you need to know about Singapore property for foreigners is the purchase process. Buying property in Singapore as a foreigner involves several steps, such as checking your eligibility, securing your financing, paying your taxes and fees, and completing your legal formalities. In this section, we will explain each step in detail and provide you with some useful tips and general resources.

Eligibility Criteria

The first step in buying property in Singapore as a foreigner is to check your eligibility. Depending on your residency status, you may have different buying rights and restrictions. There are three main categories of residency status in Singapore: citizens, permanent residents (PRs), and foreigners.

- Citizens: Citizens are Singaporeans who hold a Singapore passport and enjoy full rights and privileges in the country. Citizens can buy any type of property in Singapore, including HDB flats, ECs, and private properties. Citizens also enjoy various subsidies and grants from the government, such as the CPF housing grant, the HDB loan, and the ABSD remission.

- Permanent Residents (PRs): PRs are foreigners who have been granted the right to live and work in Singapore indefinitely but without the full rights and privileges of citizens. PRs can buy HDB flats, ECs, and private properties, but with some restrictions. For example, PRs can only buy HDB flats from the resale market, and they need to pay an ABSD of 5% for their first property and 15% for their subsequent properties. PRs can also apply for some subsidies and grants from the government, such as the CPF housing grant and the HDB loan, but with lower amounts than citizens.

- Foreigners: Foreigners are non-Singaporeans who do not have any residency status in Singapore. They can be tourists, visitors, students, workers, or investors. Foreigners can only buy private properties in Singapore, and they need to pay an ABSD of 20% for any property they buy. Foreigners cannot apply for any subsidies or grants from the government, and they can only get a bank loan or a foreign currency loan to finance their property purchases.

To check your eligibility for buying property in Singapore as a foreigner, you can visit the Singapore Land Authority website and fill out the online application form. You will need to provide information such as your nationality, residency status, income, and property ownership status. You will also need to declare if you have any economic contributions or family ties to Singapore, which may affect your eligibility.

FAQs

- Q: How can I become a PR or a citizen in Singapore?

- A: To become a PR or a citizen in Singapore, you will need to apply through the Immigration and Checkpoints Authority (ICA) and meet the eligibility criteria, such as having a valid employment pass, a spouse or a child who is a citizen or a PR, or a substantial investment in Singapore. You will also need to submit various documents, such as your passport, identity card, educational certificates, income tax returns, and testimonials. The application process may take several months or years, depending on the demand and the availability of slots.

- Q: What are the benefits of becoming a PR or a citizen in Singapore?

- A: Some of the benefits of becoming a PR or a citizen in Singapore are:

- You can buy more types of property in Singapore, such as HDB flats and ECs, and enjoy lower taxes and fees.

- You can access more subsidies and grants from the government, such as the CPF housing grant, the HDB loan, and the ABSD remission.

- You can enjoy more rights and privileges in Singapore, such as voting, education, healthcare, and social security.

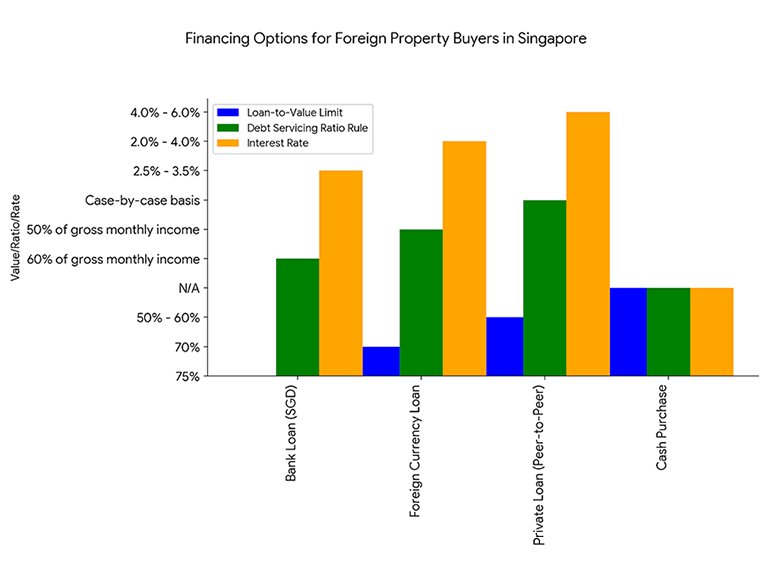

Financing Options

The next step in buying property in Singapore as a foreigner is to secure your financing. Depending on the type of property you want to buy and your financial situation, you may have different financing options available. Generally, there are two main types of financing options for foreigners: bank loans and foreign currency loans.

- Bank Loans: Bank loans are loans that are denominated in Singapore dollars and offered by local banks, such as DBS Bank, OCBC Bank, and UOB (United Overseas Bank). Bank loans are subject to the loan-to-value (LTV) limits and the total debt servicing ratio (TDSR) rules set by the Monetary Authority of Singapore (MAS). The LTV limit is the maximum percentage of the property’s value that you can borrow from the bank, and it ranges from 55% to 75%, depending on the number and type of properties you own. The TDSR rule is the maximum percentage of your monthly income that can go towards servicing your debt obligations, and it is capped at 60%. Bank loans also have interest rates that vary depending on the bank and the market conditions, and they may have additional fees and charges, such as the application fee, the processing fee, and the cancellation fee.

- Foreign Currency Loans: Foreign currency loans are loans that are denominated in foreign currency and offered by some local banks or foreign banks, such as HSBC, Standard Chartered, and Citibank. Foreign currency loans are not subject to the LTV limits and the TDSR rules, but they are subject to currency exchange rate fluctuations and interest rate risks. Foreign currency loans may have lower interest rates than bank loans, but they may also have higher volatility and uncertainty, as the value of the loan and the repayment amount may change depending on the currency movements. Foreign currency loans may also have additional fees and charges, such as the conversion fee, the transfer fee, and the early repayment fee.

To apply for a bank loan or a foreign currency loan, you will need to provide various documents, such as your passport, employment pass, income proof, bank statements, and property valuation report. You will also need to have a good credit score and a stable income source. You can compare the different loan packages offered by different banks and lenders online, or you can consult a mortgage broker or a financial advisor to help you find the best deal for your needs and budget.

FAQs

- Q: How much can I borrow for a home loan in Singapore as a foreigner?

- A: The amount you can borrow for a home loan in Singapore as a foreigner depends on the type of loan you choose, the type of property you buy, and your financial situation. Generally, you can borrow up to 55% to 75% of the property’s value if you choose a bank loan, and up to 80% to 90% of the property’s value if you choose a foreign currency loan. However, you also need to consider your income, your debt obligations, your credit score, and your repayment ability when applying for a loan.

- Q: Which currency should I choose for a foreign currency loan?

- A: The currency you choose for a foreign currency loan should match your income currency, your repayment currency, and your investment objective. For example, if you earn and repay in US dollars, and you want to hedge against the Singapore dollar depreciation, you may choose a US dollar loan. However, you also need to consider the interest rate, the exchange rate, and the currency risk of each currency option before making your decision.

Taxes and Fees

The third step in buying property in Singapore as a foreigner is to pay your taxes and fees. Buying property in Singapore as a foreigner involves various taxes and fees, such as the buyer’s stamp duty, the additional buyer’s stamp duty, the mortgage stamp fee, the legal fee, the valuation fee, and the agent fee. These taxes and fees can add up to a significant amount, so you need to factor them into your budget and plan ahead. In this section, we will explain each tax and fee in detail and provide you with some examples and calculations.

Buyer’s Stamp Duty (BSD)

The buyer’s stamp duty (BSD) is a tax that is imposed on the purchase or acquisition of any property in Singapore, regardless of your residency status. The BSD is calculated based on the purchase price or the market value of the property, whichever is higher. The BSD rates are as follows:

| Purchase Price or Market Value of the Property | BSD Rate |

|---|---|

| First $180,000 | 1% |

| Next $180,000 | 2% |

| Next $640,000 | 3% |

| Remaining amount | 4% |

For example, if you buy a private condo in Singapore for $1.5 million, the BSD you need to pay is:

- 1% x $180,000 = $1,800

- 2% x $180,000 = $3,600

- 3% x $640,000 = $19,200

- 4% x $500,000 = $20,000

- Total BSD = $44,600

You need to pay the BSD within 14 days of signing the sale and purchase agreement, or within 30 days if the agreement is signed overseas. You can pay the BSD online or at any Singapore Post branch. You can also use your CPF savings to pay the BSD, subject to the withdrawal limits and conditions.

Additional Buyer’s Stamp Duty (ABSD)

The additional buyer’s stamp duty (ABSD) is a tax that is imposed on the purchase or acquisition of residential properties in Singapore, depending on your residency status and the number of properties you own. The ABSD is calculated based on the purchase price or the market value of the property, whichever is higher. The ABSD rates are as follows:

| Residency Status | Number of Properties Owned | ABSD Rate |

|---|---|---|

| Singapore Citizens | First property | Nil |

| Second property | 12% | |

| Third and subsequent property | 15% | |

| Singapore Permanent Residents (PRs) | First property | 5% |

| Second and subsequent property | 15% | |

| Foreigners | Any property | 20% |

For example, if you are a foreigner who buys a private condo in Singapore for $1.5 million, the ABSD you need to pay is:

- 20% x $1.5 million = $300,000

You need to pay the ABSD within the same timeframe and manner as the BSD. You cannot use your CPF savings to pay the ABSD.

Mortgage Stamp Fee

The mortgage stamp fee is a fee that is imposed on the mortgage loan agreement that you sign with the bank or the lender to finance your property purchase. The mortgage stamp fee is calculated based on the loan amount or the property value, whichever is lower. The mortgage stamp fee rate is $4 for every $1,000 of the loan amount, subject to a maximum of $500.

For example, if you take a bank loan of $1 million to buy a private condo in Singapore, the mortgage stamp fee you need to pay is:

- $4 x ($1,000,000 / $1,000) = $4,000

- However, since the maximum fee is $500, you only need to pay $500.

You need to pay the mortgage stamp fee within 14 days of signing the mortgage loan agreement, or within 30 days if the agreement is signed overseas. You can pay the mortgage stamp fee online or at any Singapore Post branch. You cannot use your CPF savings to pay the mortgage stamp fee.

Legal Fee

The legal fee is a fee that you need to pay to a lawyer or a law firm to handle the legal aspects of your property purchase, such as conducting due diligence, drafting and reviewing contracts, registering the property title, and transferring the funds. The legal fee varies depending on the lawyer or the law firm you choose, the complexity and the duration of the transaction, and the type and value of the property. The legal fee can range from $2,000 to $5,000 or more.

You need to pay the legal fee to your lawyer or law firm upon completion of the transaction, or as per the agreed terms and conditions. You can use your CPF savings to pay the legal fee, subject to the withdrawal limits and conditions.

Valuation Fee

The valuation fee is a fee that you need to pay to a valuer or a valuation company to assess the market value of the property you want to buy. The valuation fee is required if you are taking a bank loan or a foreign currency loan to finance your property purchase, as the loan amount will depend on the valuation report. The valuation fee varies depending on the valuer or the valuation company you choose, the type and the size of the property, and the scope and the method of the valuation. The valuation fee can range from $200 to $1,000 or more.

You need to pay the valuation fee to your valuer or valuation company upon receiving the valuation report, or as per the agreed terms and conditions. You can use your CPF savings to pay the valuation fee, subject to the withdrawal limits and conditions.

Agent Fee

The agent fee is a fee that you need to pay to a real estate agent or a property agent to help you with the property search, negotiation, and transaction process. The agent fee is usually a percentage of the property’s purchase price, and it is negotiable between you and the agent. The agent fee can range from 1% to 3% or more.

You need to pay the agent fee to your agent upon completion of the transaction, or as per the agreed terms and conditions. You cannot use your CPF savings to pay the agent fee.

FAQs

- Q: How can I reduce the taxes and fees I need to pay for buying property in Singapore as a foreigner?

- A: Some of the ways you can reduce the taxes and fees you need to pay for buying property in Singapore as a foreigner are:

- Choose a property that has a lower purchase price or market value, as this will lower the BSD and the ABSD you need to pay.

- Choose a property that is not subject to the ABSD, such as a commercial or industrial property, or a landed property in Sentosa Cove, if you have the approval from the SLA.

- Choose a property that is jointly owned by a Singapore citizen or a PR, as this may lower the ABSD rate or qualify for the ABSD remission, depending on the number and type of properties owned by each co-owner.

- Choose a smaller loan amount or a shorter loan tenure, as this will lower the mortgage stamp fee and the interest cost you need to pay.

- Choose a reputable and experienced lawyer, valuer, and agent, who can offer you competitive and reasonable fees for their services.

- Q: How can I estimate the total taxes and fees I need to pay for buying property in Singapore as a foreigner?

- A: You can use online calculators and tools, such as the Property Buyer Stamp Duty Calculator, and the Additional Buyer Stamp Duty Calculator

Legal Matters

The fourth step in buying property in Singapore as a foreigner is to complete the legal formalities. Buying property in Singapore as a foreigner involves various legal procedures, such as signing the option to purchase, exercising the option to purchase, registering the property title, and transferring the funds. In this section, we will explain each procedure in detail and provide you with some useful tips and resources.

Option to Purchase (OTP)

The option to purchase (OTP) is a legal document that grants you the right to buy a property from the seller within a specified period of time, usually 14 days. The OTP contains the essential terms and conditions of the sale, such as the property description, the purchase price, the completion date, and the seller’s particulars. The OTP also contains the option fee, which is a non-refundable deposit that you need to pay to the seller to secure the OTP, usually 1% of the purchase price.

To obtain the OTP, you need to engage a real estate agent or a property agent who can help you find the property, negotiate the price, and draft the OTP. You also need to engage a lawyer or a law firm who can help you review the OTP, conduct due diligence, and advise you on the legal implications. You need to sign the OTP and pay the option fee to the seller within the validity period of the OTP, or else the OTP will lapse and the option fee will be forfeited.

Exercise of Option to Purchase (EOTP)

The exercise of option to purchase (EOTP) is a legal document that confirms your intention to buy the property from the seller and forms a binding contract between you and the seller. The EOTP contains the same terms and conditions as the OTP, but with some additional clauses, such as the payment schedule, the completion date, and the warranties and representations. The EOTP also contains the exercise fee, which is another non-refundable deposit that you need to pay to the seller to exercise the OTP, usually 4% of the purchase price.

To exercise the OTP, you need to sign the EOTP and pay the exercise fee to the seller within the validity period of the OTP, or else the OTP will lapse and the option fee will be forfeited. You also need to submit the EOTP to the Inland Revenue Authority of Singapore (IRAS) and pay the buyer’s stamp duty and the additional buyer’s stamp duty within 14 days of signing the EOTP, or within 30 days if the EOTP is signed overseas. You also need to secure your financing and obtain the valuation report within the validity period of the OTP, or else you may risk losing the property or the deposits.

Registration of Property Title

The registration of property title is a legal procedure that transfers the ownership of the property from the seller to you and records your name as the legal owner of the property in the land register. The registration of property title is done by your lawyer or law firm, who will prepare and submit the necessary documents, such as the EOTP, the mortgage loan agreement, and the certificate of title, to the Singapore Land Authority (SLA). The SLA will then verify the documents, update the land register, and issue the title deed, which is a legal document that proves your ownership of the property.

The registration of property title usually takes place on the completion date, which is the date agreed upon by you and the seller in the EOTP, usually within 8 to 12 weeks of signing the EOTP. You need to pay the legal fee and the registration fee to your lawyer or law firm upon completion of the registration of the property title, or as per the agreed terms and conditions. You can use your CPF savings to pay the legal fee and the registration fee, subject to the withdrawal limits and conditions.

Transfer of Funds

The transfer of funds is a legal procedure that transfers the balance of the purchase price and the other costs and fees from you to the seller and the other parties involved in the transaction, such as the lawyer, the valuer, and the agent. The transfer of funds is done by your lawyer or law firm, who will prepare and submit the necessary documents, such as the completion statement, the redemption statement, and the settlement statement, to the bank or the lender.

The bank or the lender will then release the loan amount and the CPF savings to your lawyer or law firm, who will then disburse the funds to the seller and the other parties.

The transfer of funds usually takes place on the completion date, which is the date agreed upon by you and the seller in the EOTP, usually within 8 to 12 weeks of signing the EOTP. You need to pay the balance of the purchase price and the other costs and fees to your lawyer or law firm upon completion of the transfer of funds, or as per the agreed terms and conditions.

You can use your bank loan or your foreign currency loan to pay the balance of the purchase price and the other costs and fees, subject to the loan amount and the repayment terms.

FAQs

- Q: How can I find a reputable and experienced lawyer, valuer, and agent to help me with the legal matters of buying property in Singapore as a foreigner?

- A: Some of the ways you can find a reputable and experienced lawyer, valuer, and agent to help you with the legal matters of buying property in Singapore as a foreigner are:

- Ask for referrals and recommendations from your friends, family, colleagues, or acquaintances who have bought property in Singapore before, especially if they are foreigners.

- Search online and offline for reviews, ratings, testimonials, and credentials of various lawyers, valuers, and agents who specialize in foreign property transactions.

- Visit the websites and online platforms of various lawyers, valuers, and agents who offer their services and portfolios to potential clients.

- Consult a professional association or a regulatory body, such as the Law Society of Singapore, the Singapore Institute of Surveyors and Valuers, or the Council for Estate Agencies, to verify the qualifications, experience, and reputation of the lawyers, valuers, and agents you are considering.

- Q: What are the common mistakes and pitfalls to avoid when dealing with the legal matters of buying property in Singapore as a foreigner?

- A: Some of the common mistakes and pitfalls to avoid when dealing with the legal matters of buying property in Singapore as a foreigner are:

- Signing the OTP, the EOTP, or the mortgage loan agreement without reading and understanding the terms and conditions, or without seeking legal advice.

- Failing to pay the option fee, the exercise fee, the buyer’s stamp duty, the additional buyer’s stamp duty, or the mortgage stamp fee within the stipulated time frame, or failing to provide the required documentation to the pertinent authorities.

- Failing to secure your financing or obtain the valuation report within the validity period of the OTP, or failing to meet the loan-to-value limits or the total debt servicing ratio rules set by the MAS.

- Failing to complete the registration of property title or the transfer of funds within the completion date, or failing to pay the legal fee, the registration fee, the balance of the buying amount, or the additional expenses and fees to the relevant parties.

Risks and Considerations for Foreign Buyers

Another thing you need to know about Singapore property for foreigners is the risks and considerations. Buying property in Singapore as a foreigner involves various risks and considerations, such as market volatility, second properties rules, and the cultural etiquette. In this section, we will explain each risk and consideration in detail and provide you with some useful tips and resources.

Market Volatility

The market volatility is the risk that the property market may fluctuate unpredictably and affect the value and the returns of your property investment. The property market in Singapore is influenced by various factors, such as the supply and demand, the economic conditions, the government policies, and the global events.

The property market in Singapore can be volatile and unpredictable, as evidenced by the UBS Global Real Estate Bubble Index, which ranks Singapore as one of the most overvalued and risky property markets in the world.

To mitigate the market volatility risk, you need to do your research and analysis before buying property in Singapore as a foreigner. You need to understand the market trends, prices, and availability of different properties, and compare them with your investment objectives, budget, and risk appetite.

You also need to diversify your investment portfolio and hedge against the currency and inflation risks. You can also consult a professional financial advisor or a real estate agent who can help you make informed and prudent decisions.

Second Properties Rules

The second properties rules are the rules that apply to you if you already own a property in Singapore or overseas, and you want to buy another property in Singapore as a foreigner. The second properties rules are mainly the additional buyer’s stamp duty (ABSD) rates and the total debt servicing ratio (TDSR) limitations, which we have explained in the previous sections. The second properties rules are designed to discourage speculation and ensure financial prudence among property buyers.

To comply with the second properties rules, you need to declare and prove your property ownership status when buying property in Singapore as a foreigner. You need to pay the higher ABSD rates for your second and subsequent properties, and you need to meet the lower TDSR limits for your mortgage loan applications. You also need to consider the opportunity cost and the cash flow implications of owning multiple properties, and whether they are worth the investment.

Cultural Etiquette

The cultural etiquette is the consideration that you need to respect and adapt to the local customs and practices when buying property in Singapore as a foreigner. Singapore is a multicultural and multiracial society, with four official languages and various religions and ethnicities. Singaporeans are generally friendly and courteous, but they may also have different expectations and preferences when it comes to property transactions.

To observe the cultural etiquette, you need to be aware and sensitive of the cultural differences and nuances when buying property in Singapore as a foreigner. You need to communicate clearly and politely with the seller, the agent, the lawyer, and the other parties involved in the transaction. You also need to negotiate fairly and reasonably, and avoid making lowball offers or unreasonable demands. You also need to follow the legal procedures and the contractual obligations, and avoid any disputes or conflicts.

FAQs

- Q: How can I monitor and forecast the property market trends in Singapore?

- A: Some of the ways you can monitor and forecast the property market trends in Singapore are:

- Visit the websites and online platforms of various government agencies, such as the Urban Redevelopment Authority (URA), the HDB, the SLA, and the MAS, to access the official data and statistics on the property market, such as the property price index, the property supply, the property transactions, and the property regulations.

- Visit the websites and online platforms of various real estate agencies, such as the PropertyLimBrothers, to access the market insights and analysis on the property market, such as the property trends, the property outlook, the property hotspots, and the property tips.

- Visit the websites and online platforms of various media outlets, such as the Straits Times, the Business Times, and the Edge Singapore, to access the news and reports on the property market, such as the property news, the property features, the property opinions, and the property interviews.

- Q: What are the benefits and drawbacks of owning multiple properties in Singapore?

- A: Some of the benefits and drawbacks of owning multiple properties in Singapore are:

- Benefits:

- You can increase your income and wealth by renting out or selling your properties at a profit.

- You can diversify your investment portfolio and hedge against the market risks and the currency risks.

- You can enjoy more lifestyle options and flexibility by having different properties for different purposes and occasions.

- Drawbacks:

- You have to pay more taxes and fees, such as the ABSD, the property tax, and the agent fee, for your second and subsequent properties.

- You have to meet more financial obligations and regulations, such as the TDSR, the LTV, and the MOP, for your mortgage loans and your property ownership.

- You have to manage more responsibilities and challenges, such as the maintenance, vacancy, and tenant issues, for your property investment.

- Benefits:

Finding the Perfect Property and Secure the Deal

The final step in buying property in Singapore as a foreigner is to find the perfect property and secure the deal. Finding the perfect property and securing the deal involves various steps, such as searching for the property, viewing the property, making an offer, and closing the deal. In this section, we will explain each step in detail and provide you with some useful tips and resources.

Searching for the Property

The first step in finding the perfect property and securing the deal is to search for the property. Searching for the property involves finding the property that matches your needs, preferences, and budget. There are many factors to consider when searching for the property, such as the location, the size, the design, the amenities, the facilities, the price, and the potential returns.

To search for the property, you can use various resources, such as online platforms, real estate agents, and property showrooms. Online platforms, such as PropertyGuru, 99.co, and EdgeProp, allow you to browse and compare thousands of properties across Singapore, based on various criteria, such as the property type, the property size, the property price, and the property location.

Real estate agents, such as the PropertyLimBrothers, can help you find the property, negotiate the price, and handle the transaction process, based on your requirements, expectations, and goals. Property showrooms, such as the Boulevard 88, the Wharf Residences, and the Normanton Park, allow you to view and experience the property in person, and get a feel of the quality, the layout, and the ambiance of the property.

Viewing the Property

The second step in finding the perfect property and securing the deal is to view the property. Viewing the property involves visiting and inspecting the property in person, and evaluating the condition, the features, and the suitability of the property. Viewing the property is an important step, as it allows you to verify the information and the images you have seen online or offline, and to discover any issues or defects that may affect your decision.

To view the property, you need to arrange an appointment with the seller or the agent, and prepare a checklist of things to look out for, such as the exterior, the interior, the fittings, the fixtures, the appliances, the utilities, the maintenance, and the surroundings. You also need to ask questions and take notes, such as the reason for selling, the history of the property, the tenure of the property, the monthly expenses of the property, and the future plans of the property.

You also need to be respectful and courteous, and avoid making any comments or criticisms that may offend the seller or the agent.

Making an Offer

The third step in finding the perfect property and securing the deal is to make an offer. Making an offer involves proposing a price and a deposit that you are willing to pay for the property, and expressing your interest and intention to buy the property. Making an offer is a crucial step, as it determines whether you can secure the property or not, and whether you can get a good deal or not.

To make an offer, you need to do your research and analysis, and determine a fair and reasonable price for the property, based on the market value, the market conditions, the property condition, and the property potential. You also need to decide on a deposit amount, which is usually 5% of the purchase price, and which will be forfeited if you back out of the deal.

Furthermore, you will need to communicate your offer to the seller or the agent, and provide supporting documents, such as your passport, your employment pass, your income proof, and your loan approval. Prepared also to negotiate and compromise, and to accept or reject any counter-offers from the seller or the agent.

Closing the Deal

The final step in finding the perfect property and securing the deal is to close the deal. Closing the deal involves finalizing the terms and conditions of the sale, signing the sale and purchase agreement, paying the balance of the purchase price and the other costs and fees, and receiving the keys and the title deed of the property. Closing the deal is the most satisfying step, as it marks the completion of your property purchase and the start of your property ownership.

To close the deal, you need to follow the legal procedures and the contractual obligations, as we have explained in the previous sections. You also need to coordinate with the seller, the agent, the lawyer, the valuer, the bank, and the other parties involved in the transaction, and ensure that everything goes smoothly and timely. You also need to inspect the property before the handover and check for any defects or damages that may affect your satisfaction and enjoyment of the property.

Conclusion

Buying property in Singapore as a foreigner can be a rewarding and fulfilling experience, but it also requires a lot of research, planning, and preparation. In this article, we have provided you with a comprehensive guide on everything you need to know about Singapore property for foreigners, from the types of property you can buy, to the eligibility criteria, to the financing options, to the taxes and fees, to the legal matters, to the risks and considerations, to the property search and purchase process.

We hope that this article has given you a clear and comprehensive overview of the Singapore property market, and has helped you make informed and confident decisions based on your needs and goals.

However, this article is not intended to be a substitute for professional advice, and we strongly recommend that you seek the guidance and assistance of a qualified and experienced real estate agent, lawyer, valuer, and financial advisor before buying the property. These professionals can help you navigate the complex and dynamic property market, and provide you with customized and tailored solutions that will suit your specific situation and circumstances.